Resources

Managing Your Money Saving and investing Emergency Funds: Things to Consider Saving for retirement Filing taxes Budgeting Quick-Fix Budget Adjustments What to Know Starting a Budget Online Budget Tool Debt Management Credit card management Protecting your credit and identity Debt relief programs Managing student loan debt

Establishing or changing careers can be a very exciting yet stressful time. To help make the immediate and future financial implications of the event easier to deal with, investigate your options and create a plan to address: Retirement account options: Should you leave the money in the 401K held by your former employer? Is it …

There are many difficult decisions to be made when caring for an aging family member, so it’s important to establish a financial strategy and processes for if and when that situation arises. While aging family members are still lucid Create a written list of important contacts such as their attorney, CPA, insurance agents, bankers, doctors …

Research has proven that working with a financial advisor to meet your retirement goals provides significant monetary value. In fact, Vanguard studies have shown that those who utilize a financial advisor see an approximately 3.0% additional increase in their net portfolio returns over time. While many think stock selection is the primary driver of these …

Losing a loved one is heart wrenching. On top of the emotional toll, there are many steps you have to take to navigate the legalities and financial implications of the loss. Use this checklist as a starting point for these steps. Locate Important Papers A copy of the death certificate (Get from the funeral director) Will, …

Dealing with a divorce involves more than the emotional complications. Your financial situation is also likely to change considerably. You can reduce the stress of the situation by taking some of these steps: Severe all unnecessary financial ties with the ex-spouse Contact lenders and cancel all joint accounts and have new cards issued in just your …

It may be hard to believe, but your children are grown and have left home. Now it’s time to ask yourself what to do with an empty nest. Big financial changes occur once children are grown. It’s time to consider how best to move through this transition. Things to consider with an empty nest Revise …

Roth IRA conversions offer investors three main benefits: tax diversification, no required minimum distributions, and more flexible liquidity. But before we get into specifics, let’s first review the basics of traditional vs Roth IRAs. Tax Diversification Converting to a Roth IRA is largely a tax transfer or tax diversification issue for most investors. For example, …

The question was asked, the answer was yes. You are getting married! While there is much to celebrate, there are also a variety of financial implications you need to consider. Planning for a wedding can be a stressful time, but it’s important to consider the cost of the wedding as well as create a smart financial …

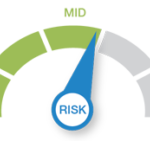

When it comes to investing, the risk/return tradeoff is a commonly accepted principle. Low risk means sacrificing the potential for growth while high risk offers potential for higher returns, but with greater uncertainty. Accurately identifying your own risk tolerance, the degree of variability in investment returns you’re willing to withstand, is a critical step when …

If pregnancy or adoption means your family is about to get bigger, there are some easy steps you can take help not only satisfy your newest family member’s immediate needs, but to plan for his or her long-term needs as well Things to Consider with a Growing Family Get a Social Security number for your …

Buying or selling a house can be very stressful. Here are some tips that can help guide you through the process. Things to Consider When Buying a Home Set up a savings plan so you have enough to make a 20% down payment Determine how much you can spend total Determine your maximum monthly mortgage …

Thinking about contributing to a Health Savings Account (HSA)? Get a full understanding of its benefits before you begin. Who Qualifies for an HSA? Must be covered under a high deductible health plan on the first day of the month Cannot be enrolled in Medicare Cannot be claimed as a dependant on another tax return …

When you start savings can make a bigger impact than how much you save later on.

The fundamental question all investors must answer is how much risk they are willing to take to obtain their desired return. For Stephen Kuzniak, Financial Advisor at Cannon Financial Strategists, it’s a question that not only drives his daily work with clients, but one that has been the focus of considerable research. “I’m always looking …

Retirees have several innovative options to maximize their Social Security benefits. Download Creative Social Security Strategies– Understanding the Nuances to learn the rules and take advantage of the strategies available for retirement planning.

Cost-of-living adjustments (COLAs) result in an increase of income for retirees who receive Social Security benefits, and they also boost unclaimed benefits. Download How COLAs Affect Social Security Benefits to see how inflation factors into the benefit formula whether you’re working or collecting.

Underestimating life expectancy can have dramatic effects on retirement planning. Download Life Expectancy and Social Security and read more about how to maximize your benefits in the event of extreme longevity.

It is important to consider the lifetime value of Social Security and the long-term effects if one or both spouses live a very long time. Download Social Security as Longevity Insurance to learn about maximizing Social Security income by delaying the start of benefits to age 70.

The decision of when to apply for Social Security benefits is crucial in retirement planning. Download When to Apply for Benefits to learn more about identifying the optimal time to take Social Security and maximizing your benefit.

Continued earnings could increase your Social Security benefit depending on your situation. Learn more about the impact working has on Social Security by downloading Will Working Longer Help or Hinder Your SS Benefit?

Click on the following link to download a copy: Personal Budget Worksheet Household Budget Worksheet (Discretionary v. Necessary)

Taxes are an inevitability in life, yet many people are unaware of how their investments are impacted by the ever-shifting tax code. Of all the expenses investors pay, taxes can be the biggest expense on total returns. With that in mind, it’s easy to see why awareness of tax-efficiency is integral to managing a portfolio. Learn more about …

Think about the various professionals you engage in the course of a year. Most people don’t service their own car, install their own HVAC unit or conduct their own medical check-ups. Think of what could go wrong! However, many people wonder about the value of working with a financial advisor. Just like any professional, a financial advisor’s …

This private K-12 school has been a TIAA-CREF client since 1960. In February 2013, concerned about managing its fiduciary responsibilities, the school expressed an interest in hiring a financial consultant to serve as co-fiduciary for its retirement plan. After a formal RFP search, the School selected Cannon Financial Strategists, Inc. (Cannon). In addition to serving as the plan’s co-fiduciary, Cannon is …

Profile Private medical practice with four doctors that experiences steady growth. The Challenge The practice added employees to the point that its Simplified Employee Pension (SEP) plan became too costly in terms of contributions to employees relative to the amount the doctors were contributing for themselves. The Objectives After taking a comprehensive look at the …

Profile 2,000 employee hospital with multiple vendors in their retirement benefits program. The Challenge Changes in tax law and reporting requirements had made it increasingly cumbersome to deal with multiple record-keepers, administrators and vendors. Employees were confronted with a mixed bag of variable annuity funds and fixed accounts, including proprietary funds and some with unnecessary …

In today’s world, a host of information is at your fingertips any time of day or night. That means stock market news is available the second you want it. While you may think following the news to manage your stocks—make changes based on what’s happened or what you think might happen next—is a smart strategy, …